Jan Dul & Jari Kaivo-oja:

Grand challenges in the industry in the Industry 4.0 era

Under the banner of ‘Industry 4.0’ a new industrial revolution is unfolding. New technologies and digital transformation force manufacturing companies to prepare for the future and to utilize new technologies for ensuring their competitiveness in markets. The road to a successful end result crosses a jungle of different new technologies, new possibilities of digitalization, and changing roles of humans. For survival, companies need new strategies and plan to reach their targets. Is the Finnish industry ready for this?

To be able to answer this question we need to ask if our “national machine” (ministry, decision-makers in industry, education institutes, politics, and the public opinion) is prepared for this inevitable change in industries. We already know that the industry sectors must acquire new technologies and make steps towards digitization. We also know that there is a huge need for increasing people’s skills and competencies in the industry to work with these novel technologies like Industrial and Service Internet of Things, AI, AR/VR, Cloud computing, Digital Twin tech set, Blockchain, sensory technology, 3D printing of different components, cobots for helping humans at work, Food security. Nanosensors in packaging to detect salmonella and other contaminants in food etc.

We also know the challenges of an aging workforce and the awareness that technologies take over many human work tasks, and at the same time, new roles and work tasks are coming for humans. Technological and human challenges go hand in hand and the human factor will remain a core element of a successful Finnish industry. Now there is a need for integrated humans and systems approach in the design and management of production systems and of future work. This allows to maximally use of the potential of humans as being part of the production system. This knowledge is largely available in the human factors and ergonomics field and can readily be applied in the Finnish industry.

In economic terms, low quality of integration of human factors creates a negative effect on the national economy e.g. due to inefficiency of the systems and cost of bad working conditions. Although we are economically and socially developed we are ergonomically undeveloped. This is not only a question of money but attitude and capability to utilize HFE (Human Factors Engineering) knowledge in general. The critical question is who will compensate for this kind of broad-scale negative effect in society or are just sending a high-cost bill to taxpayers?

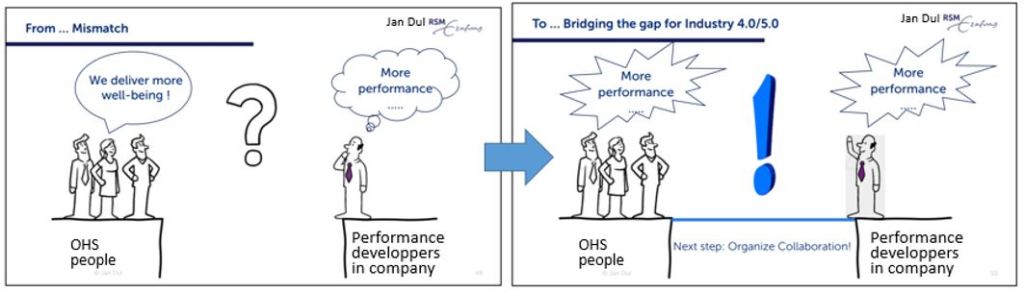

For being successful we need to nurture this unused human potential in the right way. When designing or changing production systems we must ensure a mutual development of technology and manufacturing processes by using human factors in design for ensuring a good fit between the two human and the work systems, not only in large companies but also in small and medium-sized companies. Do we have capabilities for making this happen at the national, industry, and company level? The simple answer is “no”. At the national level, industrial policies for technological development by the ministry of economic affairs (e.g. Renewing and Competent Finland 2021−2027 Program, TEM industrial sectoral reports, AI 2.0 Report etc.) are quite isolated from social policies for human development by the ministry of health and labor (e.g., future of work where integration of HFE in the design of systems and processes is neglected.) At the industry level, separate national policies are being discussed and implemented for specific industries in separate initiatives. At the company level engineers and other technical experts work on changing production systems separately from occupational health and safety (OHS) experts.

In Finland, Industry 4.0 is fully technology-driven, and attention to the human factor at work is fully driven by occupational health and safety. For example, the guideline of the Ministry of Social Affairs and Health intends to help Finnish companies with health and safety issues only but is not taking into account optimizing the interfaces between humans and the other parts of the manufacturing process for improving the performance of the entire system, humans included. The same holds for the health-driven activities proposed in The Occupational health 2025 – In cooperation workability and health.

We can also wonder if the “Work 2030” vision and strategy take an integrative approach to link technology, economy, and human factors for enhancing the cooperation and development between these three core actors in the industry. The skill of HFE makes it possible to combine all needed collaborators and stakeholders together for integrating the HFE into engineering and management work. As a multidisciplinary field, HFE is a must and while respecting the identity of different fields we need to recognize the existing barriers to be able to do cooperation between different fields of knowledge.

The policy is needed for combining technologies, business, and people in workplaces

As a production system consists of all activities that are either produced by humans or by machines, the design of a production system is about designing both activities in concert. This means that even when technologies and digitalization are made for improving the performance of the manufacturing process, humans make the final impact on how things will go in reality – in good or bad. System performance can only be realized while taking into account the human factor. If human factors and ergonomics (HFE) are not orchestrated professionally in companies, large-scale negative effects are created in the whole society on the company and national level.

A ‘human factors’, the HFE approach ensures a fit between humans, technology, and the entire production process. It maximizes system performance while maintaining good standards of ergonomics. It means that systems, work, and works environment are realized for maximizing what technology can do, and what people can and want to do. In this approach technology, organizational and human expertise are combined and optimized for maximum output in terms of the economic and social goals of the system. International evidence shows that designing work processes in such a way can serve both goals simultaneously.

How can this be realized in Finland? What is our policy that combines the development of performance of the production processes and well-being of workers at the same time?

The Finnish Human Factors Engineering way

What is the status in companies of the integration of HFE in the design and management while preparing for Industry 4.0? Now, according to the law, OHS-driven activity is a must for companies. In Finland, occupational health services and professionals help companies to develop the workability of the workers and ensure healthy and safe work environments. They focus on optimizing the load of the work for the worker throughout the whole work process and the work life. Good so far, but how will this be possible without HFE expertise in an era of Industry 4.0 where human-system integration is essential? HFE refers to Ergo Nomos = Work Laws of nature which is the science and theory for designing work processes. This internationally accepted definition of HFE and ergonomics is largely absent in Finland. Companies do not get this HFE knowledge from current OHS services and professionals when searching for and choosing new solutions to modern Industry 4.0 production. In Finish public opinion there is a common understanding that occupational health services offer ‘ergonomists for workplaces’, but this idea of ergonomics is limited to the health and safety of workers, and does not deal with system performance.

On the positive side, the Finnish law recognizes the difference between OHS professionals and OHS experts. The physiotherapist is one of the OHS professionals and the ergonomist is the OHS expert. However, the OHS field does not make a distinction between physiotherapists (who is called `occupational physiotherapists ‘in public) and ergonomist. In Finland `Occupational physiotherapist` represents narrow health and safety based definition of ergonomics. This has led to the situation that companies get most often an occupational physiotherapist for tackling true ergonomics issues instead of the ergonomics (HFE) expert that is mentioned in the law. This is an obvious problem in the Finnish work life at the moment. For these reasons, the multidisciplinary approach to the development of working life is thin from the broader system perspective.

Ergonomics is a science, theory and principles that takes a system approach and deal with the interfaces between human and other parts of the system. This means engineering kind of work for optimizing the work for human. HFE takes into account the physical, cognitive and organizational aspects of the work and work system. This approach is helping to integrate human via HFE knowledge as a part of the process proactively on macro and micro levels. In Finland, unfortunately, we see only reactive micro level OHS activity because of health problems of the workers. We cannot survive a long time with this kind of one sided and siloed OHS approach with health and medicine sciences. We need a national level policy that notice the need for fixing the gap between OHS activities and performance and productivity development activities in companies and public sector organizations for combining HFE and performance knowledge.

Figure 1. The Gap problem. Source: Jan Dul´s lecture in ERGO2030 Webinar, in the Palace, Helsinki, Wednesday 10.11.2021.

Innovations for integrating HFE for improving performance of the companies

For being able to succeed in this change in the industry for ensuring the competitiveness of our companies, the productivity of the work, and wellbeing at work, we need an integrated policy that leads OHS, HFE experts, and performance developers to define the performance factors to be noticed, studied, analyzed and designed for ensuring the fit between human and work system. It is good to be aware that part of the recent poor productivity development of work in Finland is due to poor human ergonomics knowledge in design. Solving this big problem needs understanding of the system approach where existing theories and practices are offered to the use of the companies in this industry and technology change process.

ERGO 2030 project brought as an example, facts and factors to be noticed for this systemic and organizational approach by creating a road map to be utilized in different industries and companies. However, this roadmap does not help unless we do not have a policy in Finland that facilitate the OHS and business/technology actors to work together and especially if the education and services of design ergonomics for work systems are not in place and available for companies and technology suppliers.

Let`s bring the key stakeholders around this topic of human, work, productivity, and well-being at work at the same table and listen to the needs and requirements for creating a mutual understanding how shall the national level roadmap looks like for ensuring the capability of our industry and wellbeing of the workers at work. In another case, we are not able to implement efficient digital and new technology transformation in the industry. This negative alternative will lead us to very slow organizational adaptation processes in industries, low work productivity levels, and to huge negative externalities to society. This big financial cost and bill will be paid by taxpayers.

And last but not least. Industry 5.0 is said to be human-centered but can it be realized without having HFE in place in Industry 4.0? The answer is `no`. Using HFE skills already in Industry 4.0 phase makes us better prepared for Industry 5.0 phase. If this is not taken into account now problems maybe even bigger in industry 5.0 what comes to HFE and phenomena related to that in work-life practices.

Jan Dul

Professor, Rotterdam School of Management, Erasmus University, the Netherlands

Jari Kaivo-oja

Research Director, Finland Futures Research Centre, University of Turku

About the ERGO 2030 project

ERGO2030 project was funded by the Anita and Olavi Seppänen Memorial Foundation, founded in 2018 in Helsinki, Finland. The Foundation actively supports Finnish art and culture, and national orthopedic research as well as maintains the historic church and its environment of Tuupovaara in Eastern Finland.

ERGO 2030 report was published in 2021: Reiman, A., Parviainen, E., Lauraéus, T., Takala, E-P., & Kaivo-oja, J. (2021) ERGO 2030 – a roadmap for human consideration in the design and application of new technologies in industry. Tutu ePublications 3/2021: https://www.utupub.fi/handle/10024/152322

About the authors

Professor Jan Dul is a professor of Technology and Human Factors at the Rotterdam School of Management, Erasmus University, the Netherlands. He has a background in the technical, the medical and the social sciences. His is a specialist in human factors and ergonomics (HFE) and studies the interaction between people and the physical and social-organizational environment to maximize business performance and human well-being. His research contributes to the design of successful products and services, and to the development of work environments for high performance (creativity, innovation, productivity, quality, health and safety). He is the winner of several national and international awards including the Human Factors NL award, the Hal W. Hendrick Distinguished International Colleague Award of the USA human factors and ergonomics society, the IEA Distinguished Service Award of the International Ergonomics Society, and the Liberty Mutual award for the paper ‘A strategy for human factors/ergonomics: developing the discipline and profession’. He has advised the EU and national governments about work environment policies, is a regular speaker at management events worldwide, and has shared his insights with companies on how to improve performance with HFE.

Dr. Jari Kaivo-oja is an Adjunct Professor and Research Director working at the Finland Futures Research Centre, University of Turku. He is a researcher in the Manufacturing 4.0 project funded by the Strategic Research Council of the Academy Finland. He was scientific expert in the ERGO2030 project. He has worked in various European research and development projects serving among others the European Foundation for the Improvement of Living and Working Conditions (European Foundation/Eurofound), the European Agency for Safety and Health at Work (EU OSHA), the European Commission, the European Parliament and the EU DG Enterprise and Industry (DG-ENTR).

Articles

- Reiman, A., Kaivo-oja, J., Parviainen, E., Takala, E-P. & Lauraeus, T. (2021). Human factors and ergonomics in manufacturing in the Industry 4.0 context – A scoping review. Technology in Society. 65, https://doi.org/10.1016/j.techsoc.2021.101572

- Reiman, A., Kaivo-oja, J., Parviainen, E. Lauraeus, T. & Takala, E-P. ”Human work in Industry 4.0: A road map to technological changes in manufacturing”. Journal manuscript in review

Chapters:

- Reiman, A., Kaivo-oja, J., Parviainen, E. Lauraeus, T. & Takala, E-P. ”Human Work in the Manufacturing Industry 4.0”. Book chapter in review for textbook: Operator 4.0 by Springer.

- Takala, E-P. & Reiman, A. Ergonomia. Article to Fysiatria. 6. edition 2023. Duodecim.

Conference papers:

- Takala, E-P., Reiman, A., Parviainen, E., Lauraeus, T. & Kaivo-oja, J. (2021). ERGO 2030 – A roadmap for the implementation of human factors within the newest technology. In: Black, N., Neumann, P.W., Dewis, C. & Noy, I. (Eds.), Book of Extended Abstracts, 21st Congress of the International Ergonomics Association, Vancouver, Canada, 14-18 June 2021, pp. 389-392.

The final ERGO report:

- Reiman, A., Parviainen, E., Lauraéus, T., Takala, E-P., & Kaivo-oja, J. (2021) ERGO 2030 – tiekartta ihmisen huomioimiseen suunniteltaessa ja sovellettaessa uutta teknologiaa teollisuudessa. Tutu eJulkaisuja 3/2021: https://www.utupub.fi/handle/10024/152322

Picture Stefan Keller Pixabay